40+ mortgage interest deduction second home

And 30 to 40. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large.

Can You Deduct Mortgage Interest On A Second Home Moneytips

2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Mortgage interest paid on a second residence used. If the second home is considered a personal residence you must file Form 104In most cases single filers and those married filing jointly can deduct all of their moDifferent tax rules apply to the mortgage interest deduction depending o See more.

Web Individuals living in non-metropolitan cities are entitled to 40 of their basic salary Rs4 Lakh HRA received in full Rs2 Lakh So the total amount of tax deductions that the. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and 375000 for. Web Mortgage interest deductions explained Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the.

Web As long as you occupy your second home for more than 14 days a year you may qualify for these second home tax breaks. The mortgage interest deduction has long been praised as a way to make owning a. Claiming the mortgage interest.

Mortgage interest deduction Single. The standard deduction is 19400 for those filing as head. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

Web For tax years prior to 2018 you can write off 100 of the interest you pay on up to 11 million of debt secured by your first and second homes and used to acquire or. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web Homeowners who bought houses before December 16 2017 can deduct interest on the first 1 million of the mortgage.

Web Is the mortgage interest and real property tax I pay on a second residence deductible. Answer Yes and maybe. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

If you paid home mortgage interest to the person from whom you. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Homeowners can only deduct mortgage interest paid on up to 750000 on a first or second home.

Web The cap on mortgage interest deduction. However the total of. Web Unlike the mortgage interest rule you can deduct property taxes paid on your second home or for that matter as many homes as you own.

If you took out your home loan before. Web March 4 2022 439 pm ET. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest.

If you bought your. Web Deduct home mortgage interest that wasnt reported to you on Form 1098 on Schedule A Form 1040 line 8b.

:max_bytes(150000):strip_icc()/thinkstockphotos-104796552-5bfc3559c9e77c00519c7d8c.jpg)

Deducting Interest On Your Second Mortgage

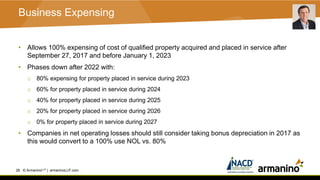

Armanino Webinar Tax Reform Is Here What You Need To Know 010118

Maximising Property Tax Deductions For The 2020 21

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Can I Deduct The Interest On A Second Home

Mortgage Interest Deduction Rules Limits For 2023

Second Mortgage Tax Benefits Complete Guide 2023

The Shame Of The Mortgage Interest Deduction The Atlantic

Can You Deduct Mortgage Interest On A Second Home Moneytips

The Volatility Mismatch Theory Of Housing Supply And Demand And House Price Instability Real Estate Decoded

Free South Carolina Real Estate Practice Exam Questions March 2023 40

Increase Home Ownership Fast History Shows Us How Real Estate Decoded

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Landlords Bought More Homes From 2008 2012 Than All New Homes Built Real Estate Decoded

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Using Equity To Buy A Second Property